Brookfield Asset Management (BAM)·Q4 2025 Earnings Summary

Brookfield Asset Management Posts Record Q4: FRE Surges 28%, Teskey Takes CEO Reins

February 4, 2026 · by Fintool AI Agent

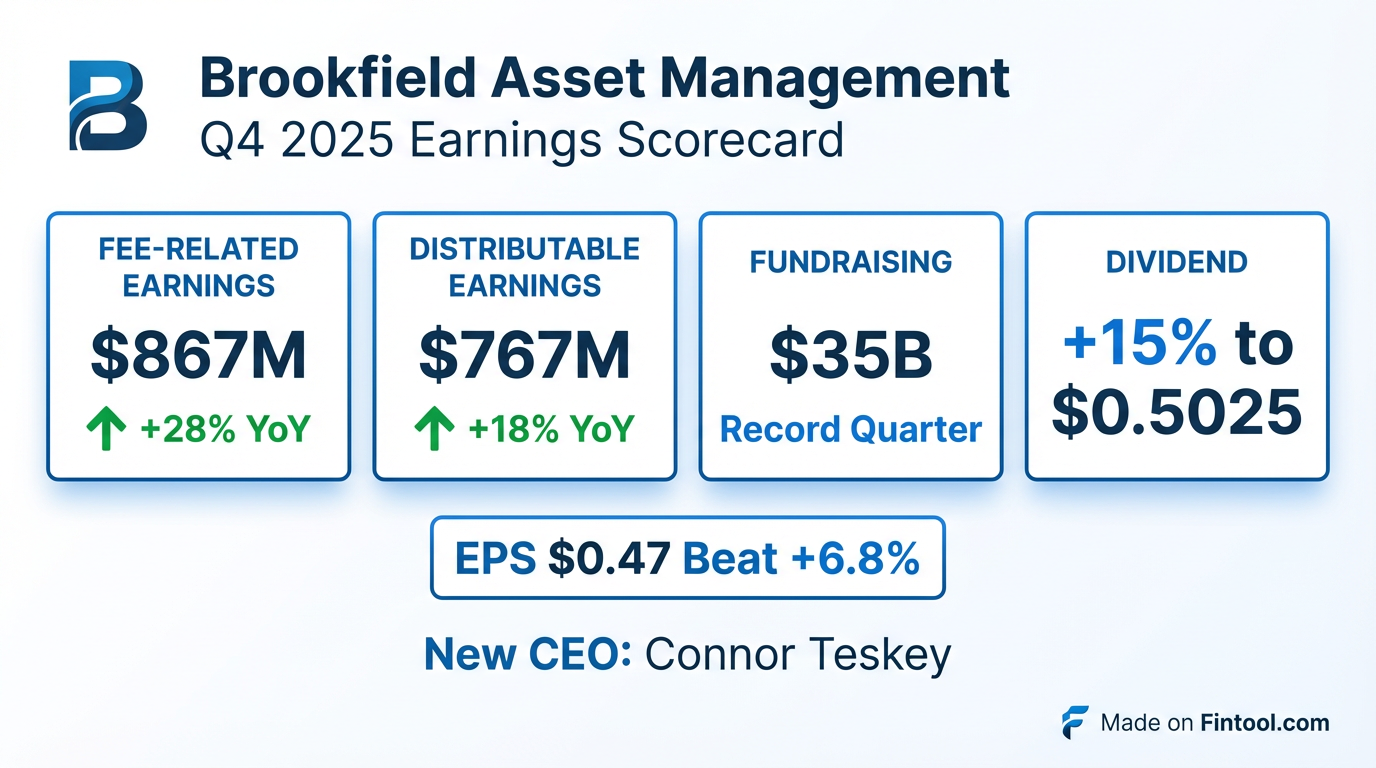

Brookfield Asset Management delivered its strongest quarter since listing, with fee-related earnings jumping 28% year-over-year to a record $867 million as record fundraising of $35 billion powered asset growth. The alternative asset manager also announced a 15% dividend increase and named Connor Teskey as CEO, succeeding Bruce Flatt who remains Chairman.

Did Brookfield Asset Management Beat Earnings?

EPS: Beat by +6.8% | Revenue: Miss by -2.8%

BAM stock rose 3.3% in premarket trading following the results, trading around $50.80 versus the prior close of $47.37.

Quarterly results summary:

Note on Upcoming Disclosure Changes: When BAM closes the Oaktree acquisition, reported margins will decline due to Oaktree's lower margin profile (driven by countercyclical business mix). Additionally, BAM will begin breaking out partner manager revenues and expenses separately, rather than just reporting their FRE share.

What Drove the Record Quarter?

Record Fundraising Momentum

BAM raised a record $35 billion in Q4 2025 and $112 billion for the full year, driven by strong inflows across credit, infrastructure, and insurance channels.

Q4 2025 Fundraising by Segment:

Fee-bearing capital reached $603 billion, up 12% year-over-year.

Strong Deployment and Monetizations

The market environment supported both deployment and exits:

What Did Management Guide?

Connor Teskey, newly appointed CEO, expressed confidence in the growth outlook:

"2025 was another record year for our business—across each of fundraising, deployment, and monetizations. Our fee-bearing capital grew to over $600 billion, with 22% year-over-year growth in fee-related earnings and 14% growth in distributable earnings. Looking ahead, we will have key flagship strategies in the market and a growing suite of complementary offerings, positioning us to drive sustained growth across multiple channels."

2026 Growth Drivers:

Teskey on the outlook:

"We expect 2026 is going to be very strong... In our five-year plan, we expect growth rates in, call it, the mid- to high teens, and we absolutely have an outlook today that exceeds that level."

Guidance Catalysts:

- Multiple flagship funds expected to hold first closes in H1 2026

- Seventh vintage private equity flagship fund launching—expected to be largest ever

- $100 billion global AI infrastructure program with $10B BAIIF fund targeting first close H1 2026

Strategic Initiatives: AI and Oaktree

$100 Billion AI Infrastructure Program

BAM launched a transformational AI infrastructure initiative:

- BAIIF Fund: Targeting $10B in equity commitments, already secured $5B

- Qatar Partnership: $20B strategic AI joint venture with Qai focusing on integrated AI infrastructure in Qatar

- Focus Areas: AI factories, power generation, compute infrastructure, and strategic adjacencies

Teskey emphasized that power is the key bottleneck, not capital or demand:

"The bottleneck to AI growth today is not capital, it is not demand, it is electricity supply. Our ability to bring unique solutions beyond just simply flowing power through the grid is a key differentiator."

BAM's power solutions include Bloom Energy for quick-to-deliver power, Westinghouse for nuclear solutions, and behind-the-meter energy storage and renewables that can be connected directly to data center complexes.

Oaktree Acquisition Completion

BAM is acquiring the final 26% of Oaktree it doesn't already own for approximately $3 billion:

- BAM funding: ~$1.6B

- Brookfield Corporation funding: ~$1.4B

- Expected close: H1 2026

This will fully consolidate Oaktree's fee-related earnings, carried interest, and partner manager interests under BAM.

CEO Transition: Teskey Takes the Helm

Connor Teskey (age 38) was appointed CEO effective February 3, 2026.

Teskey's Background:

- President of BAM since 2022

- Head of Brookfield Renewable Power and Transition since 2020

- CEO of Brookfield Renewable Partners

- Joined Brookfield in 2012; prior experience in corporate debt origination at a Canadian bank

- Bachelor of Business Administration from University of Western Ontario

Bruce Flatt commented on the transition:

"We began this process four years ago when Conor was appointed president of BAM. Over that time, Conor has taken on running virtually everything, so this title change merely matches title to substance. There is hence no real transition."

Teskey on his new role:

"I'm honored to be assuming this new role, especially at such an exciting time in BAM's growth story. With Bruce's support and the incremental approach to transition we have been taking for years, we are already fully operating under our new structure."

Additionally, Bruce Karsh (Oaktree co-founder) was appointed to the Board, succeeding William Powell.

15% Dividend Increase

The Board declared a quarterly dividend of $0.5025 per share, representing a 15% increase.

How Did the Stock React?

BAM stock showed strong positive momentum following the results:

Recent Earnings Track Record:

Balance Sheet and Liquidity

In November, BAM issued $1 billion in senior notes:

- $600M 5-year notes at 4.653%

- $400M 10-year notes at 5.298%

Of the $134B in uncalled commitments, $63B will commence earning fees of approximately $630M annually once deployed.

Full Year 2025 Summary

Q&A Highlights

DeepSeek/AI Disruption: "Strong Net Positive"

When asked about AI-related disruption concerns following the January market selloff, Teskey emphasized Brookfield's minimal software exposure and positive positioning:

"This is a strong net positive for our business. It validates our focus on digital infrastructure and servicing increased power demand to support the growth and increased penetration of AI. Within our private equity portfolio, we have less than 1% exposure to software businesses. Within our credit business... we have no software exposure."

Secondaries: "Near Top of the List"

CFO Hadley Peer Marshall indicated secondaries would be a priority acquisition target:

"In terms of secondaries, it is a space we track very closely. It's growing rapidly. It's a segment of the market where our expertise would be very clearly differentiating... If we were going to do something, secondaries is probably near the top of the list."

Private Wealth: 40%+ Growth to Continue

Teskey outlined the roadmap for wealth channel expansion:

"2025, our growth in the wealth channel was a little bit north of 40%. We expect that to continue in 2026, particularly on the back of a number of new products we launched... notably in the credit and private equity segments."

401(k) Channel: Regulatory Catalysts Expected

"We do expect guidance to come later this week, which we expect will be highly supportive of alternatives in 401ks, and will include... initiatives that will create catalysts for increased reviews of alternatives within these portfolios."

FRE Margins: Operating Leverage Continuing

Peer Marshall on margin expansion trajectory:

"The margins for our business will continue to improve because of that operating leverage that's built in across all of our platforms. In fact, when we look forward, especially for 2026, every business should have stronger margins, except maybe real estate, only because they don't have the catch-up fees."

Credit Redemptions: "Modest and Manageable"

On private credit concerns and retail redemptions:

"Across the market, there were most increases in retail redemptions or wealth redemptions late last year. For us, these were very modest and very manageable... on the institutional side, we're still seeing very robust inflows into credit."

Forward Catalysts to Watch

- Flagship Fund Closes (H1 2026): First closes expected for seventh-vintage PE fund (largest ever) and BAIIF AI infrastructure fund

- Oaktree Integration: Final 26% acquisition expected to close H1 2026, adding fee-related earnings

- AI Infrastructure Execution: Deployment of $100B global AI program with Qatar JV partnership

- CEO Transition: Connor Teskey's strategic priorities and potential renewable/transition focus

- Insurance Channel Growth: Continued expansion through Brookfield Wealth Solutions